The numbers of e-commerce platforms confirm a trend already established in recent years: user purchases are increasingly happening online.

What developments can we expect in the next few years? Who are the top players in the sector, and what are their values? How has the pandemic changed consumer purchasing habits? Let's look at some data that gives us a better understanding of the extent of this phenomenon.

The value of e-commerce globally is approximately $ 15,751 billion.

It is divided as follows:

- B2C 23,0 %

- B2B: 77,0 %

In 2019, 14.1% of retail sales in the world were via e-commerce. The incidence of online sales on total retail sales is estimated to reach 22% by 2023.

Spending by category worldwide (billions of dollars)

- 620,1 $ Fashion & Beauty

- 456,9 $ Elettronica & Media fisici

- 168,8 $ Food & Personal Care

- 316,7 $ Mobili ed Accessori

- 382,2 $ Giochi & Hobby

- 13,5' $ Trilion Viaggi & Accomodation

- 13,59 $ Musica digitale

- 83,15 $ Videogiochi

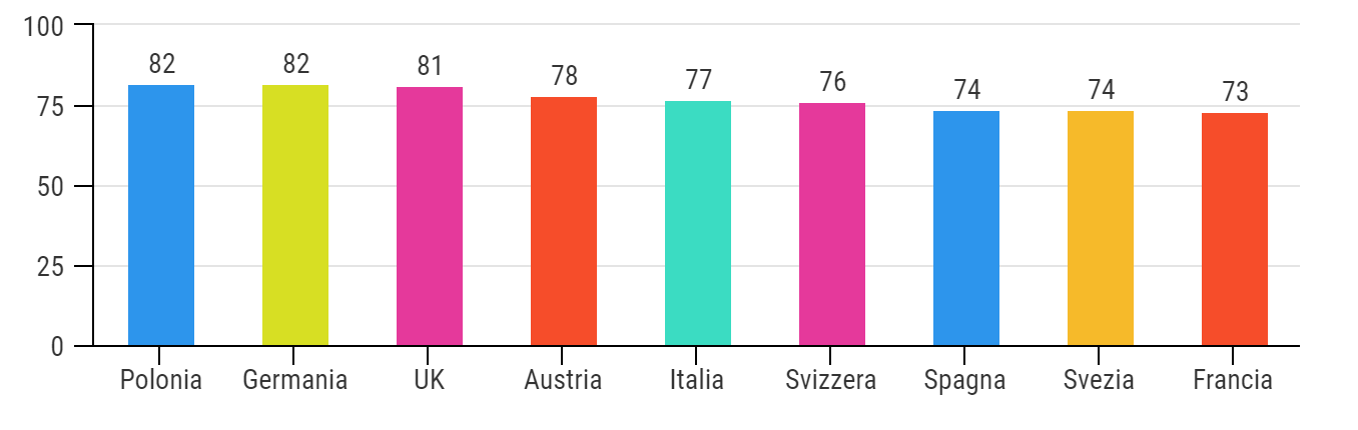

Percentage of internet users aged 16 to 64 who have bought online in recent months

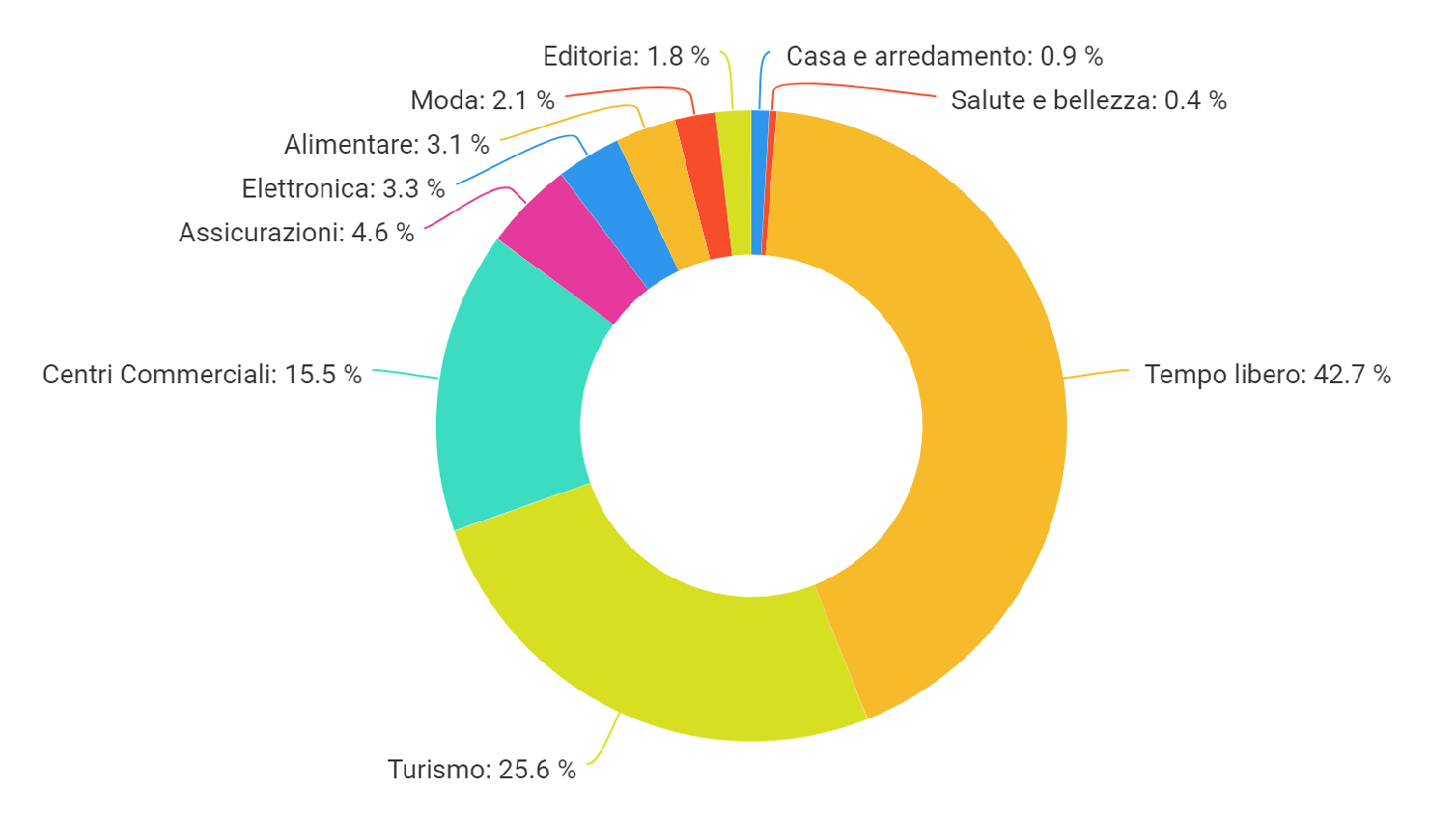

E-COMMERCE IN ITALY

Of the 60 million Italians, 49.5 million are internet users.

24 million are active in e-commerce. The turnover of the sector increased by 200% in the period 2014-2019.

The value of e-commerce in our country stands at 48.5 billion

76% of Italian e-commerce users have made purchases from mobile devices in the past year, against a European average of 64%.

98% of users bought through marketplaces last year, and 31.6 million people bought online from foreign sites. In particular, they buy from:

- China

- UK

- United States

- Germany

Payment methods in Italy

- 41% credit cards

- 8 % cash

- 10 % bank transfer

- 29% e-Wallet

- 12 % other

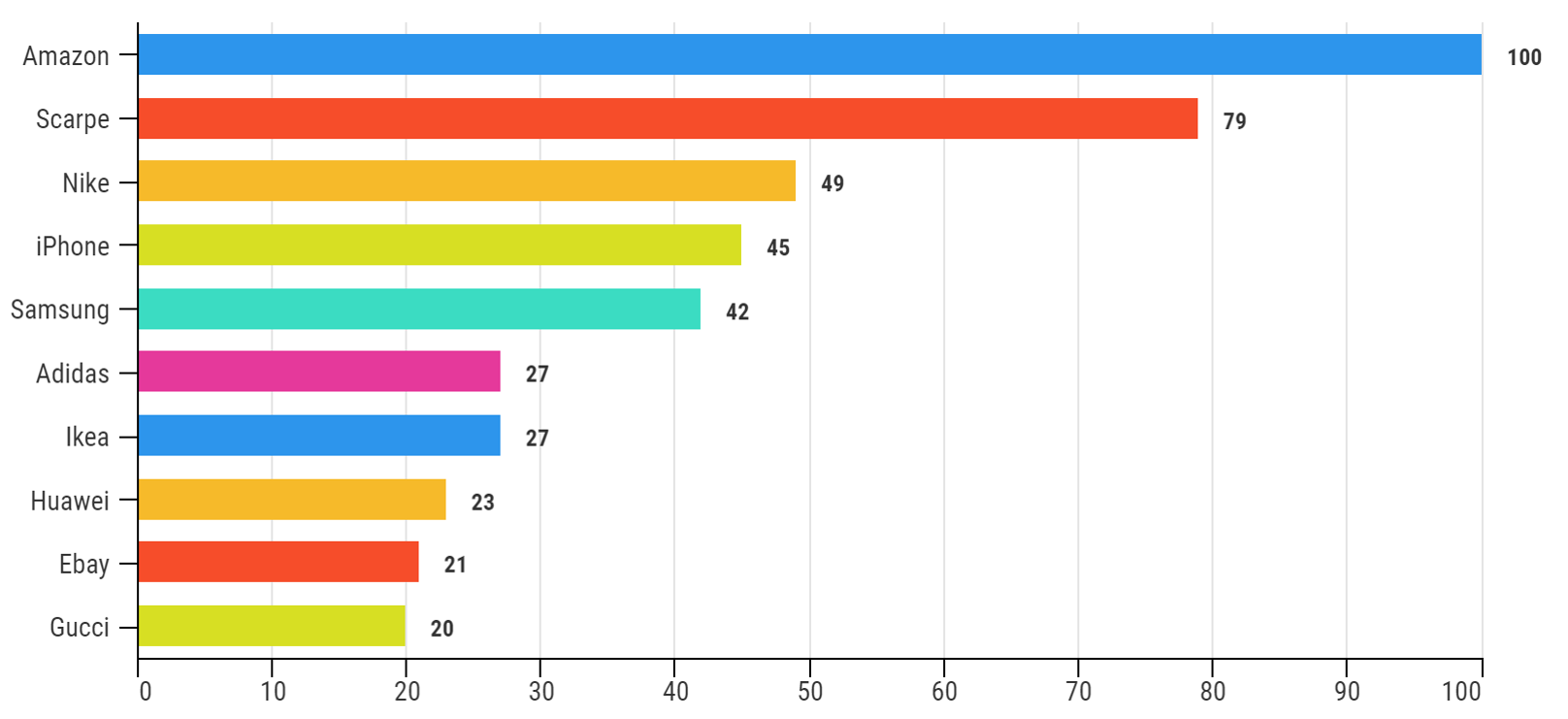

Most frequent e-commerce searches on Google

Focus: Covid

Covid has undoubtedly changed shopping habits around the world and in Italy. We have seen a general increase in online transactions and a rush by companies to open or upgrade e-commerce sales channels. This presented a major challenge, particularly for logistics, in general and for individual stores.

The categories with the greatest increase in interest

- safety at work

- webcams

- awnings

- treadmills

- gloves

- car parts

- rugs

- garden chairs

- evening wear

- swimming pools

The categories with the greatest decline in interest

- Car seat accessories

- Women's shoes

- Sports shoes

- Snow chains

- Car seats

- Suitcases

- Playmobil

- Indoor shoes

- Satellite navigators

- Football boots

April 18. 2022

April 18. 2022